News

Data Centre Infrastructure News & Trends

Innovations in Data Center Power and Cooling Solutions

Liquid Cooling Technologies Driving Data Centre Efficiency

Products

Carrier launches CDU with 2°C ATD

Carrier, a manufacturer of HVAC, refrigeration, and fire and security equipment, has introduced a new coolant distribution unit (CDU), designed to support the growing use of liquid cooling in UK data centres while improving energy performance, resilience, and space utilisation.

The Carrier CDU is intended to help operators manage higher rack densities and increasing cooling demands. It is designed to support liquid-cooled IT environments and provide greater control over energy use and system uptime.

As liquid cooling becomes more widely adopted to meet efficiency targets, the CDU enables deployment at scale through management of secondary coolant loops. Carrier says this can help reduce pumping energy and optimise heat removal across varying load conditions.

Thermal performance and system efficiency

The CDU uses modular heat exchangers that can deliver approach temperatures as low as 2°C, compared with more typical 4°C systems. According to Carrier, this can enable up to 15% chiller energy savings, allowing more electrical capacity to be allocated to IT loads rather than cooling.

Oliver Sanders, Data Centre Commercial Director UK&I, Carrier HVAC, notes, “Data centre leaders across the UK are focused on increasing capacity without increasing risk.

“This new Carrier CDU supports that goal by giving operators greater thermal stability, more flexibility in system design, and better visibility of cooling performance. The result is improved energy efficiency and smoother scalability as liquid cooling demand grows.”

The CDU is designed for use in mission-critical environments and includes redundant pumps and power supplies to support continued operation during maintenance or unexpected events.

Intelligent controls manage fluid temperatures and flow rates in real time, with the aim of maintaining stable conditions for high-density servers while reducing energy consumption.

Integration, scalability, and monitoring

Carrier states that the CDU is designed for simplified integration into existing facilities, allowing liquid cooling to be introduced with minimal disruption.

The product range includes multiple unit sizes from 1.3 to 5 MW, enabling operators to align cooling capacity with current and future high-density requirements.

The system is intended to support direct-to-chip cooling as well as mixed cooling environments. Carrier says it is designed to maintain stable performance under fluctuating workloads and higher ambient temperatures.

“Liquid cooling adoption is accelerating, and operators want systems that deliver both efficiency and certainty,” Oliver continues. “With this Carrier CDU, customers can integrate high-density workloads confidently, knowing their cooling system is designed to maximise uptime, efficiency, and long-term value.”

The CDU integrates with Carrier’s control platforms to support centralised monitoring, performance optimisation, and energy management. This is intended to help data centre teams track cooling trends, respond to load changes, and plan capacity more effectively.

The Carrier CDU forms part of Carrier’s QuantumLeap portfolio of data centre technologies.

For more from Carrier, click here.

Joe Peck - 26 January 2026

Data Centre Infrastructure News & Trends

Innovations in Data Center Power and Cooling Solutions

Products

STULZ updates CyberRack Active Rear Door cooling

STULZ, a manufacturer of mission-critical air conditioning technology, has launched an updated version of its CyberRack Active Rear Door, aimed at high-density data centre cooling applications where space is limited and heat loads are increasing.

The rear-mounted heat exchanger is designed to capture heat directly at rack level, using electronically commutated fans to remove heat at the point of generation. The updated unit is intended for use in both air-cooled and liquid-cooled data centre environments.

Integrated sensors monitor return and supply air temperatures within the rack. Cooling output is then adjusted automatically in line with server heat load, aiming to maintain consistent thermal performance as workloads fluctuate.

Designed for high-density and retrofit environments

Valeria Mercante, Product Manager at STULZ, explains, “The tremendous growth of high-performance computing and artificial intelligence has driven server power densities higher than ever, creating significant heat challenges.

“With data centre space often at a premium, the CyberRack Active Rear Door is precision engineered to deliver maximum cooling capacity in a footprint depth of just 274mm.

"Delivering up to 49kW chilled water cooling with large heat exchanger surfaces and EC fans, it also supports higher water temperatures and can extend free cooling hours. This helps reduce overall energy consumption and operating costs.”

The compact footprint means the unit can be installed without rack repositioning, making it suitable for retrofit projects and sites with limited floorspace.

Custom adaptor frames are available to support a range of rack sizes and deployment models, including standalone use, supplemental precision air conditioning, and hybrid configurations alongside direct-to-chip liquid cooling.

For maintenance, the system includes a two-step door opening of more than 90°, providing access to fans and coils. Hot-swappable axial fans with plug connectors are also designed to simplify servicing and reduce downtime.

Differential pressure control adjusts fan speed in line with server airflow requirements, while low noise operation is also specified.

The CyberRack Active Rear Door includes the STULZ E² intelligent control system, featuring a 4.3-inch touchscreen interface. The controller supports functions such as redundancy management, cross-unit parallel operation, standby mode with emergency operation, and integration with building management systems.

Valeria continues, “The updated CyberRack Active Rear Door embodies our commitment to providing air conditioning solutions that combine cutting edge technology with intelligent design, user friendliness, energy efficiency, flexibility, and reliability.

“In environments where space is tight, heat loads are high, or there’s no raised floor, these advanced units can deliver highly efficient cooling, regardless of the server load.”

For more from STULZ, click here.

Joe Peck - 23 January 2026

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Hyperscale Data Centres: Scale, Speed & Strategy

News

Report: How Slough became Europe's largest DC cluster

Kao Data, a developer and operator of data centres engineered for AI and advanced computing, has published a new report examining how Slough has evolved into Europe’s largest data centre cluster - and the UK’s de facto AI Growth Zone (AIGZ) - hosting over 675 Megawatts (MW) of hyperscale data centre capacity, while contributing more than 14,000 jobs and over £30 million in annual business rates to the local economy.

The new report, ‘The Quiet Revolution: How Data Centres Remade Slough and Secured the UK’s Digital Future’, was released just as the UK marks 12 months since the inception of the Government’s AI Opportunities Action Plan, which proposed the creation of AIGZs to accelerate infrastructure deployments in support of the country’s AI and economic ambitions.

Kao Data’s new report, produced with support from Carbon3IT and Parisi, demonstrates that such a growth zone already exists in Slough, operating at around 1GW of capacity and providing a proven blueprint for regional, economic growth.

Further, it highlights the positive contribution that data centres - often incorrectly maligned as an industry which creates minimal jobs and economic impact - can have on a local community.

For example, the report reveals that data centres replaced declining manufacturing employment in the Slough region on a near one-to-one basis, and created approximately 8,000 construction jobs between 2010 and 2025, alongside hundreds of permanently skilled operational roles.

Other key findings

• Slough hosts more than 30 operational data centres with around 1GW of total capacity, including 675MW of hyperscale facilities serving UK availability zones.

• The cluster supports approximately 14,000 jobs across direct, indirect, and induced employment.

• Data centre operators contribute over £30 million per year in local business rates.

• 95% of Slough’s data centre electricity demand is backed by 100% renewable procurement.

• The Simplified Planning Zone (SPZ) framework generated £18 million in council revenues between 2014 and 2024.

• Nearly 2.7 million people with engineering, construction, and telecommunications experience live within one hour of the Slough Trading Estate.

Spencer Lamb, MD & Chief Commercial Officer at Kao Data, explains, “Slough shows, in very real terms, what happens when infrastructure is developed with planning certainty, energy availability, and a skilled workforce, and our new report demonstrates that data centres have delivered long-term job creation, significant tax revenues, and a resilient foundation for the UK’s AI and digital economies.

“We firmly believe that data centres are a force for good in this country, providing well-paid, varied, and future-proof employment, economic regeneration to post-industrial areas, and, through operator-led energy procurement, are helping transition the UK to a green economy.”

With Slough and West London’s grid constraints well documented, the economic case for developing additional regional hubs in the UK has never been more urgent.

Moreover, with data centres now designated as Critical National Infrastructure (CNI), the report concludes that the UK must create additional clusters across the country to propel regional economic growth and provide security diversity.

With Slough proving what's possible when the conditions and local governance are right, the task now is to build on that success deliberately, regionally, and at scale - starting with the UK’s AIGZs and existing city tech communities like Greater Manchester - so that Britain's AI and digital economies can be powerful and resilient.

For more from Kao Data, click here.

Joe Peck - 22 January 2026

Data Centre Infrastructure News & Trends

Enterprise Network Infrastructure: Design, Performance & Security

Products

Fluke Networks launches CertiFiber Max fibre tester

Fluke Networks, a manufacturer of network certification and troubleshooting tools, has launched CertiFiber Max, a third-generation optical loss test set designed for high-density data centre fibre testing.

The tester is built on the Versiv platform and integrates with LinkWare software. Fluke Networks states that CertiFiber Max can certify up to 24 fibres in under one second, addressing growing testing demands as fibre density increases in AI- and cloud-driven environments.

As data centre architectures evolve, contractors are under pressure to certify more fibres within tighter performance margins. Fluke Networks notes that many existing tools either limit fibre counts or rely on fan-out cables and adapters, increasing testing time and complexity.

Designed for high-density fibre certification

CertiFiber Max supports 12-, 16-, and 24-fibre MPO connectors, as well as 16- and 24-fibre MMC connectors, using field-replaceable UniPort adapters. These adapters are designed to connect directly to multiple connector types and can be replaced or upgraded on site, extending the working life of the tester.

The company says this approach allows technicians to adapt to changing connector standards without replacing test equipment, while also protecting tester ports during use in demanding environments.

Vineet Thuvara, Chief Product Officer at Fluke Corporation, comments, “CertiFiber Max reflects our belief that trust in data centre operations starts at the physical layer. Built on the proven Versiv platform, it delivers native 24-fibre support for high-density networks.”

As fibre counts continue to rise, the company positions its CertiFiber Max as a tool designed to support both current installations and future requirements, including emerging connector formats such as MMC.

Charlie Stroup, Applications Engineering Manager at US Conec, notes, “As MMC deployments continue to expand rapidly, Fluke’s CertiFiber Max plays a critical role in supporting reliable testing for next-generation AI networks.”

The system measures optical loss, length, and polarity across multiple fibres in under a second and uses the one-jumper reference method recommended by industry standards and manufacturers.

For more from Fluke Networks, click here.

Joe Peck - 21 January 2026

Data Centre Infrastructure News & Trends

Innovations in Data Center Power and Cooling Solutions

Liquid Cooling Technologies Driving Data Centre Efficiency

Products

Motivair introduces scalable CDU for AI data centres

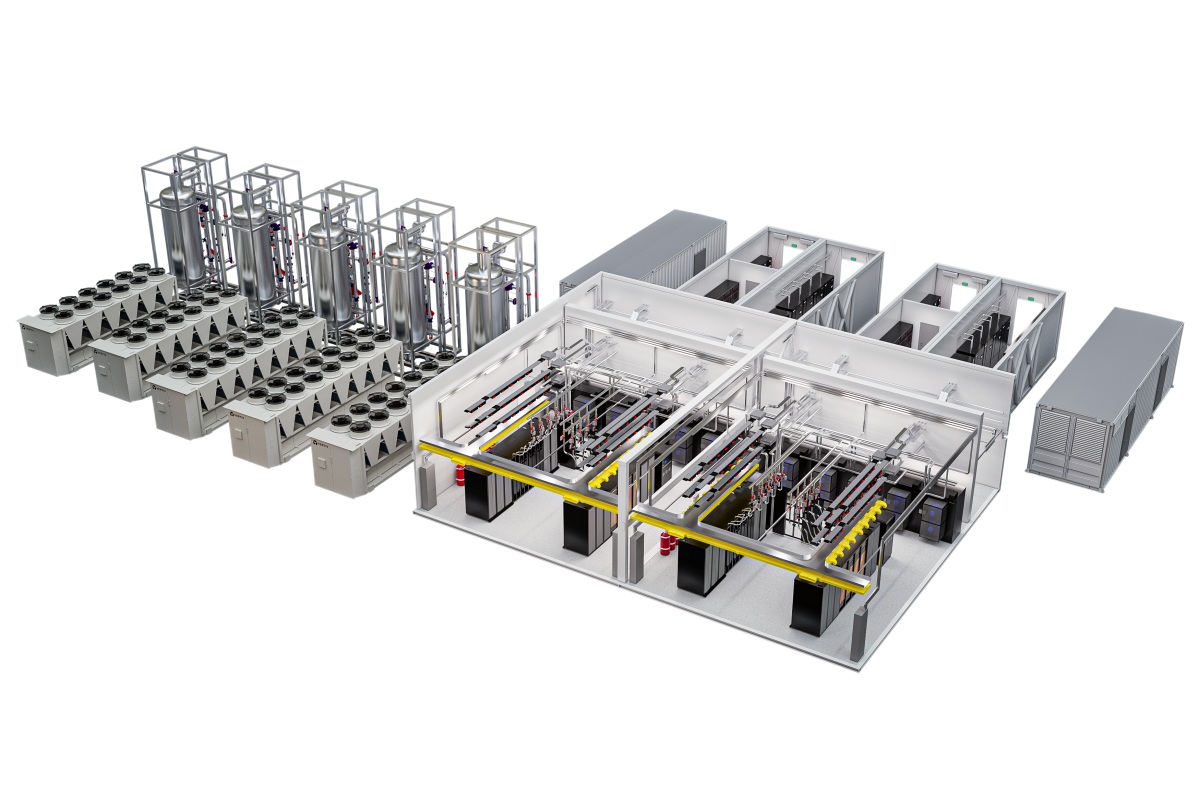

Motivair, a provider of liquid cooling systems for data centres, owned by Schneider Electric, has announced a new coolant distribution unit designed to support high-density data centre cooling requirements, including large-scale AI and high-performance computing deployments.

The new CDU, MCDU-70, has a nominal capacity of 2.5 MW and is intended for use in liquid-cooled environments where compute density continues to increase.

Motivair says the system can be deployed as part of a centralised cooling architecture and scaled beyond 10 MW through multiple units operating together.

According to the company, the CDU is designed to support current and future GPU-based workloads, where heat output is significantly higher than traditional CPU-based infrastructure.

It notes that rack power densities in AI environments are expected to approach one megawatt and above, increasing the need for liquid cooling approaches.

Designed for scalable, high-density cooling

Motivair states that the new CDU integrates with Schneider Electric’s EcoStruxure platform, allowing multiple units to operate as part of a coordinated system. The design is intended to support phased expansion as cooling demand grows, without requiring major redesign of the wider plant.

Rich Whitmore, CEO of Motivair by Schneider Electric, comments, “Our solutions are designed to keep pace with chip and silicon evolution. Data centre success now depends on delivering scalable, reliable infrastructure that aligns with next-generation AI factory deployments.”

The CDU forms part of Schneider Electric’s wider liquid cooling portfolio, which includes systems ranging from lower-capacity deployments through to multi-megawatt installations.

Motivair says the units are designed as modular building blocks, enabling operators to select and combine systems based on specific performance and redundancy requirements.

The system is manufactured through Schneider Electric's facilities in North America, Europe, and Asia, and is intended to provide high flow rates and pressure within a compact footprint.

The company adds that the design supports parallel filtration, real-time monitoring, and integration with other cooling components to support efficient operation across the data centre.

The MCDU-70 is now available to order globally.

For more from Schneider Electric, click here.

Joe Peck - 21 January 2026

Data Centre Infrastructure News & Trends

Innovations in Data Center Power and Cooling Solutions

Products

Vertiv expands perimeter cooling range in EMEA

Vertiv, a global provider of critical digital infrastructure, has expanded its CoolPhase Perimeter PAM air-cooled perimeter cooling range with additional capacity options and the introduction of the CoolPhase Condenser, now available across Europe, the Middle East, and Africa (EMEA).

The update is aimed at small, medium, and edge data centre environments, with Vertiv stating that the expanded range is intended to improve energy efficiency and operational resilience while reducing overall operating costs and extending equipment life.

The CoolPhase Perimeter PAM has been developed for modern data centre requirements and now incorporates the EconoPhase Pumped Refrigerant Economizer, integrated within the CoolPhase Condenser system.

Vertiv says the approach is designed to increase free-cooling operation by using a pumped refrigerant circuit that consumes less power than conventional compressor-based systems and reduces space requirements.

The range uses R-513A refrigerant, which has a lower global warming potential than R-410A and is non-flammable with low toxicity. The company notes that this aligns the system with EU F-Gas Regulation 2024/573 and supports operators seeking to reduce emissions while maintaining cooling capacity.

Designed for efficiency and regulatory compliance

Sam Bainborough, VP Thermal Management, EMEA at Vertiv, explains, “With this latest addition to the Vertiv CoolPhase Perimeter PAM range, we're making our direct expansion offering more flexible while addressing two critical challenges faced by data centre operators today: environmental compliance and operational efficiency.

“The new air-cooled models boost free-cooling capabilities to lower PUE, demonstrating our commitment to providing energy-efficient and environmentally responsible options.”

The CoolPhase Perimeter PAM includes variable-speed compressors, staged coils, and patented filtration technology, and integrates with CoolPhase Condenser units using the Liebert iCOM control platform.

The range forms part of Vertiv’s wider thermal portfolio and is supported by the company’s service organisation, covering design, commissioning, and ongoing operational support.

For more from Vertiv, click here.

Joe Peck - 21 January 2026

Data Centre Build News & Insights

Events

Exploring Modern Data Centre Design

News

Sponsored

Datacloud Middle East comes to Dubai

Taking place in Dubai, UAE on 10–12 February 2026, Datacloud Middle East will highlight the region’s rapid emergence as a global data centre hub, driven by hyperscaler investment, sovereign AI strategies, and large-scale digital transformation.

Over three days, the event will examine how the Middle East will build future-ready infrastructure to support AI at scale while advancing sustainability and innovation.

More than 50 industry experts will share insights on preparing for AI-driven workloads, with focused discussions on energy strategy, high-density design, and major developments such as Stargate UAE.

Driving data centre acceleration in the Middle East

The agenda will also address financing and delivery challenges, including capital deployment, modular construction, and international expansion.

Sessions will explore operational excellence and sustainability, showcasing advanced cooling technologies, sovereign AI initiatives, and interconnection strategies that will enable resilient, high-performance connectivity across the region.

With over 500 attendees, Datacloud Middle East will offer a comprehensive view of how gigawatt-scale campuses, cutting-edge cooling, and strategic partnerships will shape the Middle East’s AI infrastructure leadership.

Click here to secure your place now.

Joe Peck - 20 January 2026

Data Centre Infrastructure News & Trends

Enterprise Network Infrastructure: Design, Performance & Security

News

Zayo Europe partners with Reintel for network in Iberia

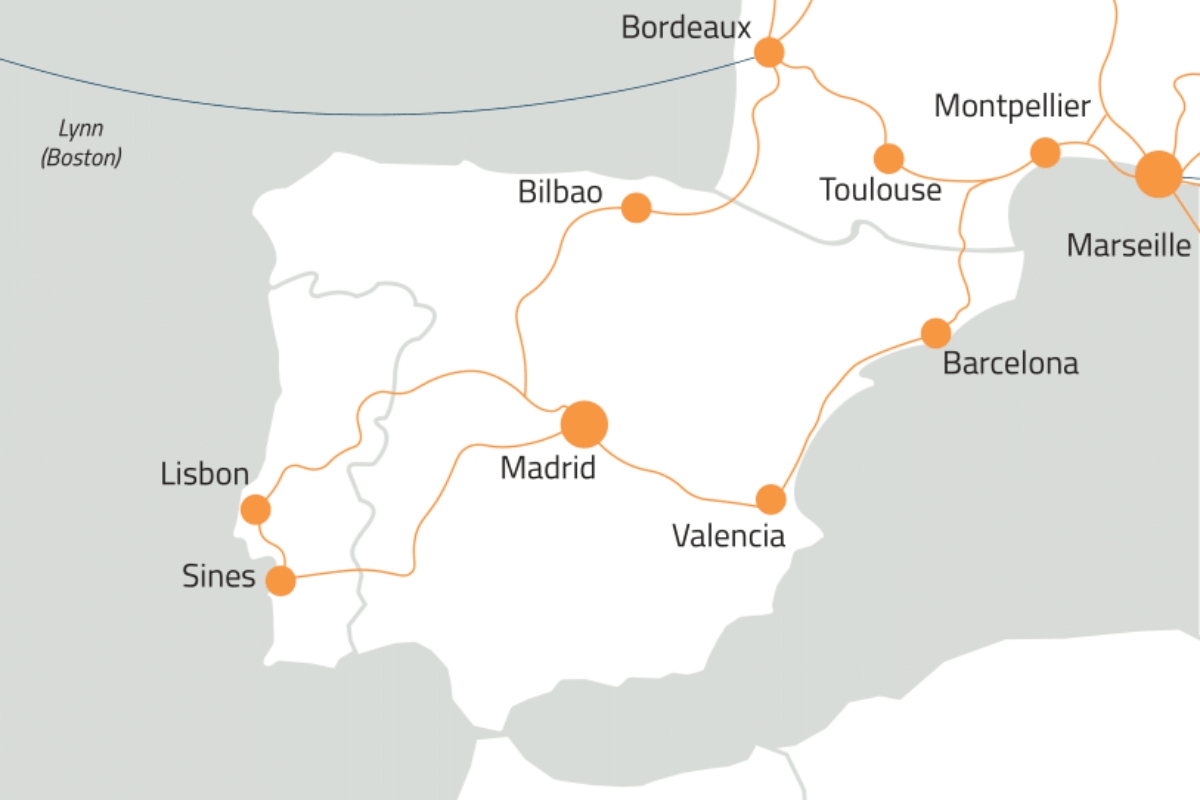

Network infrastructure provider Zayo Europe has announced a partnership with Reintel, a dark fibre operator in Spain, to expand its service offering across Iberia.

The deal marks a milestone as Zayo Europe brings its 400GE enabled wavelength network to the Iberian Peninsula as well as expanding its Tier-1 IP offering to Portugal and to more Spanish cities.

Carriers and enterprises in the region can now connect to Zayo Europe’s network, which links over 600 data centres across Europe.

The collaboration will aim to deliver low-latency, high-capacity connectivity across Iberia, connecting key business hubs including Madrid, Lisbon, Barcelona, Bilbao, and Sines.

This new route will seek to enhance network diversity, reduce deployment times, and strengthen connectivity options for businesses and carriers operating in the region.

Spanning over 3,500km of fibre across Iberia, Zayo Europe's network will enable DC-to-DC connectivity, faster cloud adoption, and high-performance handling of data-intensive workloads.

The move also strengthens Zayo Europe’s global reach, linking Iberia to international networks across the Mediterranean and Atlantic and supporting the digital transformation of businesses across multiple continents.

Emerging data centre hubs

Colman Deegan, CEO at Zayo Europe, comments, “This partnership marks another important step in Zayo Europe’s journey to connect the continent’s most dynamic markets.

"Spain and Portugal are quickly emerging as major data centre hubs, with a strong supply of renewable energy driving new investments to power AI and other cutting-edge technologies.

“We’re delighted to partner with Reintel, who operate the highest quality mission-critical fibre infrastructure in the region. By extending our network through their low-latency, high-availability fibre routes, we’re enabling enterprises, data centres, and carriers across Iberia to access our extensive high-performance connectivity that underpins Europe’s innovation economy.

"Following our recent expansion in the German market, Iberia becomes the next strategic link in furthering the reach of our pan-European network. With the significant DC rollout planned in 2026, Zayo Europe is poised to set connectivity trends for the decade ahead.”

Francisco J. Blanca Patón, CEO at Reintel, adds, “Zayo Europe’s expansion into Iberia aligns perfectly with our mission to accelerate Spain’s digital transformation.

"Combining our extensive dark fibre footprint with Zayo Europe’s international network and unparalleled service excellence creates powerful opportunities for customers across the region.

“This partnership will empower data centres and businesses across Spain and Portugal to keep pace with rising data demands and, ultimately, strengthen Europe’s digital backbone. We look forward to what can be achieved together through 2026 and beyond.”

For more from Zayo Europe, click here.

Joe Peck - 20 January 2026

Data Centre Infrastructure News & Trends

Innovations in Data Center Power and Cooling Solutions

News

APR increases power generation capacity to 1.1GW

APR Energy, a US provider of fast-track mobile gas turbine power generation for data centres and utilities, has expanded its mobile power generation fleet after acquiring eight gas turbines, increasing its owned capacity from 850 MW to more than 1.1 GW.

The company says the investment reflects rising demand from data centre developers and utilities that require short-term power to support growth while permanent grid connections are delayed.

APR currently provides generation for several global customers, including a major artificial intelligence data centre operator.

Across multiple regions, new transmission and grid reinforcement projects are taking years to deliver, creating a gap between available power and the needs of electricity-intensive facilities.

APR reports growing enquiries from data centre operators that require capacity within months rather than years.

Rapid deployment for interim power

The company says its turbines can typically be delivered, installed, and brought online within 30 to 90 days, enabling organisations to progress construction schedules and maintain service reliability while longer-term infrastructure is built.

Chuck Ferry, Executive Chairman and Chief Executive Officer of APR Energy, comments, “The demand we are seeing is immediate and substantial.

“Data centres and utilities need dependable power now. Expanding our capacity allows us to meet that demand with speed, certainty, and proven execution.”

APR states that the expanded fleet positions it to support data centre growth at a time when grid access remains constrained, combining rapid deployment with operational experience across international markets.

Joe Peck - 16 January 2026

Data Centre Infrastructure News & Trends

Innovations in Data Center Power and Cooling Solutions

Liquid Cooling Technologies Driving Data Centre Efficiency

Products

Vertiv launches new MegaMod HDX configurations

Vertiv, a global provider of critical digital infrastructure, has introduced new configurations of its MegaMod HDX prefabricated power and liquid cooling system for high-density computing deployments in North America and EMEA.

The units are designed for environments using artificial intelligence and high-performance computing and allow operators to increase power and cooling capacity as requirements rise.

Vertiv states the configurations give organisations a way to manage greater thermal loads while maintaining deployment speed and reducing space requirements.

The MegaMod HDX integrates direct-to-chip liquid cooling with air-cooled systems to meet the demands of pod-based AI and GPU clusters.

The compact configuration supports up to 13 racks with a maximum capacity of 1.25 MW, while the larger combo design supports up to 144 racks and power capacities up to 10 MW.

Both are intended for rack densities from 50 kW to above 100 kW.

Prefabricated scaling for high-density sites

The hybrid architecture combines direct-to-chip cooling with air cooling as part of a prefabricated pod.

According to Vertiv, a distributed redundant power design allows the system to continue operating if a module goes offline, and a buffer-tank thermal backup feature helps stabilise GPU clusters during maintenance or changes in load.

The company positions the factory-assembled approach as a method of standardising deployment and planning and supporting incremental build-outs as data centre requirements evolve.

The MegaMod HDX configurations draw on Vertiv’s existing power, cooling, and management portfolio, including the Liebert APM2 UPS (uninterruptible power supply), CoolChip CDU (cooling distribution unit), PowerBar busway system, and Unify infrastructure monitoring.

Vertiv also offers compatible racks and OCP-compliant racks, CoolLoop RDHx rear door heat exchangers, CoolChip in-rack CDUs, rack power distribution units, PowerDirect in-rack DC power systems, and CoolChip Fluid Network Rack Manifolds.

Viktor Petik, Senior Vice President, Infrastructure Solutions at Vertiv, says, “Today’s AI workloads demand cooling solutions that go beyond traditional approaches.

"With the Vertiv MegaMod HDX available in both compact and combo solution configurations, organisations can match their facility requirements while supporting high-density, liquid-cooled environments at scale."

For more from Vertiv, click here.

Joe Peck - 15 January 2026

Head office & Accounts:

Suite 14, 6-8 Revenge Road, Lordswood

Kent ME5 8UD

T: +44 (0)1634 673163

F: +44 (0)1634 673173