News

Data Centre Infrastructure News & Trends

Innovations in Data Center Power and Cooling Solutions

News

National Grid upgrading Oxfordshire substation to connect DCs

National Grid, the UK’s largest electricity distribution network, has started work to upgrade its Didcot substation in Oxfordshire, a key infrastructure development that will connect data centres and battery energy storage systems (BESS) to the electricity transmission network.

Situated next to the former Didcot A coal power station and just two miles from the UK’s first AI Growth Zone at Culham, the upgraded substation is aimed at supporting Britain’s digital ambitions while boosting grid capacity for future projects to plug in.

Alongside new data centres, 650MW of battery schemes will connect through the extended facility, completing a transition from ‘coal to clean’ at the site and helping to meet growing demand for flexible, zero carbon power in the region.

Details of the upgrades

The upgrade will see the existing 400kV outdoor air-insulated substation extended with three bays and three supergrid transformers, while a new 132kV indoor gas-insulated switchgear (GIS) facility will be built next door, minimising the footprint of the development and its impact on the environment.

The new GIS facility will feature Hitachi Energy’s EconiQ switchgear technology, a sustainable alternative to sulphur hexafluoride (SF6) - a greenhouse gas commonly used as an electrical insulator - marking another step in National Grid’s commitment to reduce SF6 emissions from its network by 50% by 2030.

Linxon has been appointed as principal contractor to deliver the substation upgrades, building on its collaboration with National Grid on projects such as London Power Tunnels, which will see the UK’s first SF6-free GIS substation at Bengeworth Road.

Work at Didcot comes just months after construction commenced on National Grid’s new Uxbridge Moor substation in neighbouring Buckinghamshire, which is due to connect over a dozen new data centres and which will also use SF6-free switchgear.

Peter Hancock, Project Director at National Grid Electricity Transmission, says, “Our Didcot substation extension marks another step forward in powering the UK’s digital future.

"By enabling new data centres and battery storage systems to connect to the grid, we’re supporting both the energy transition and the growth of the digital economy regionally and nationally.

“With SF6-free technology at its heart, this project reflects our commitment to building a cleaner, greener electricity network for generations to come.”

Angel Guijarro, Managing Director of Linxon Europe, adds, “Linxon’s appointment to this project is a testament to our strong partnership with National Grid and our shared vision for a sustainable energy future.

"We are committed to delivering a turnkey solution that will enhance the reliability and efficiency of Didcot substation, benefitting both local and national communities.”

Electricity demand in Britain is expected to double by 2050, with demand from data centres alone set to triple from 3% of the country’s total in 2025 to 9% by 2035.

For more from National Grid, click here.

Joe Peck - 14 November 2025

Artificial Intelligence in Data Centre Operations

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Data Centres

News

AI rush deemed "incompatible" with Clean Power Plan

A forecast suggests that the UK data centre boom is at odds with the UK’s clean power commitments, with the sector already overwhelming the electricity system and forcing an unavoidable reliance on gas. This is the view put forward by Simon Gallagher, Managing Director at UK Networks Services, speaking at Montel's UK Energy Day event earlier today (13 November).

Simon said that only firm capacity be counted on in the context of powering data centres, as adverse weather conditions would reduce the availability of wind and solar during periods of low wind and sunlight.

When asked what could realistically power tens of gigawatts worth of near constant data centre load, Simon said his “controversial opinion” was that this demand “is going to have to be met by gas.”

“It’s the only technology we have that can do this on a firm basis. We don’t have storage,” Simon added. This led him to conclude that the sector’s growth was simply not compatible with the UK government’s Clean Power 2030 plans, under which 95% of energy must come from low-carbon sources by the turn of the decade.

Physical limitations

This comes amid an explosion in grid connection requests, jumping from around 17 GW to 97 GW over the summer, pushing the total capacity waiting for connections to the UK grid up to 125 GW.

Simon continued, “About 80% of that is hyperscale data centres. It’s all AI. The impact on our grid is very real – and it just happened.” The UK was “never, ever” going to build the required transmission capacity in time, Simon added, with a new connection taking “at least five years.”

He also outlined how the infrastructure available is not where data centres want to be, adding that such facilities seek sizeable connections “at transmission voltage, in urban areas near fibre.” This would typically site them away from significant power generation zones, which could help to alleviate network constraints and reduce balancing costs.

Earlier today, Dhara Vyas, CEO of trade group Energy UK, told the same event that the UK’s clean energy expansion was being slowed by planning rules and grid connection queues that were “actively deterring investors”.

For more from Montel, click here.

Simon Rowley - 13 November 2025

Data Centre Security: Protecting Infrastructure from Physical and Cyber Threats

Products

Security Risk Management for Data Centre Infrastructure

OPTEX introduces indoor LiDAR sensor for DC security

OPTEX, a manufacturer of intrusion detection sensors and security systems, has launched the REDSCAN Lite, a short-range indoor LiDAR sensor designed to provide precise and rapid detection for protecting critical infrastructure within data centres.

Founded in Japan in 1979, OPTEX has developed a series of sensor innovations, including the use of LiDAR technology for security detection.

The company says its REDSCAN range is recognised for improving the accuracy and reliability of intrusion detection in sensitive environments.

Addressing physical security risks in critical environments

As data centres across the UK and EU are now classified as critical infrastructure, operators face increasing pressure to meet strict security standards and mitigate both internal and external risks.

Industry data indicates that nearly two thirds of data centres experienced a physical security breach in the past year.

The REDSCAN Lite uses 2D LiDAR technology to detect intrusions within a 10 m x 10 m range, reportedly responding in as little as 100 milliseconds.

The sensor can be positioned vertically to create invisible ‘laser walls’ around assets such as server racks, ventilation conduits, and access points, or horizontally to protect ceilings, skylights, and raised floors.

Engineered for high-density environments, the REDSCAN Lite is capable of detecting small-scale activities such as the insertion of USB drives or LAN cables through server racks.

It is designed to operate effectively despite temperature fluctuations, low light, or complete darkness, helping reduce false alarms common in traditional systems.

Purpose-built for confined data centre spaces

Mac Kokobo, Head of Global Security Business at OPTEX, says the product was developed in response to growing demand from data centre operators, noting, “In today’s modern environments, such as data centres, spaces are becoming tighter and tighter filling with racks and processors.

"This latest REDSCAN Lite has been developed to meet the specific need for rapid detection in tight indoor spaces where high security is crucial.

“Feedback from customers highlighted a clear need for enhanced protection in small, narrow areas and spaces, so the REDSCAN Lite sensor has been designed to fit into the narrow gaps and is engineered to provide highly accurate and fast detection in indoor spaces that other technologies simply cannot reach.”

The REDSCAN Lite RS-1010L is now available for deployment.

Joe Peck - 12 November 2025

Data Centre Infrastructure News & Trends

Enterprise Network Infrastructure: Design, Performance & Security

Events

News

Capacity Europe 2025 notes record attendance

The 24th edition of Capacity Europe, an event for global digital infrastructure and connectivity, wrapped up last week after three packed days and record-breaking attendance, cementing its status as a major event for the global connectivity ecosystem.

Hosted by provider of digital infrastructure events techoraco at the InterContinental London – The O2, the event brought together over 3,600 senior leaders from more than 100 countries, marking the largest turnout in its history.

Discussions around a changing landscape

This year’s event showcased the industry’s rapid transformation, fuelled by advances in AI and the expansion of data infrastructure, reshaping the telecommunications and digital infrastructure landscape.

With a focus on innovation, investment, and next-generation network strategy, Capacity Europe 2025 placed a spotlight firmly on the evolving digital ecosystem.

Opening the show was the keynote panel 'Disrupt to Lead: The New Telco Mindset'. The session explored how next-generation infrastructure is reshaping the telecom industry and driving operators toward new business models.

Panellists examined the evolution from traditional carriers to "techcos", blending infrastructure with value-added services and platform-based offerings that deliver on-demand, flexible experiences for enterprise customers.

Moderated by Silvia Peneva, Managing Director of GLF & ITW at techoraco, the panel featured industry figures including Annette Murphy (CCO, Colt Technology Services), Enrico Bagnasco (CEO, Sparkle), Dimitrios Rizoulis (SVP Global Connectivity, T Wholesale), Fánan Henriques (Director of Product & International Business, Vodafone Business), Valerie Cussac (CEO, Orange Wholesale International), and Mohammed Al-Abbadi (Group Chief Carrier & Wholesale Officer, STC).

“Capacity Europe 2025 has been our most impactful year yet,” notes Liss Boot-Handford, Product Director at Capacity Media, techoraco. “The energy, collaboration, and level of deal-making we’ve seen this year demonstrates how vital this event is to the industry’s future.”

Key milestones

• More than 3,600 senior leaders from over 100 countries• Upwards of 80 keynote sessions and panels• Over 250 exhibitors and sponsors• Record number of partnership deals signed on site

Across its keynote sessions and panel discussions, the event delivered insights from leaders across telecoms, cloud, edge, investment, and AI infrastructure.

Highlights included explorations of the global dynamics redefining connectivity and the race to expand digital capacity to meet AI-driven demand.

As Capacity Europe looks ahead to its milestone 25th anniversary in 2026, this year’s success sets the stage for another chapter in the evolution of global digital connectivity.

The 2026 edition will return to the InterContinental London – The O2, from 13-16 October 2026.

For more on Capacity Europe, click here.

Joe Peck - 12 November 2025

Commercial Real Estate: Property Developments, Trends & Infrastructure

Data Centre Business News and Industry Trends

News

Report: Scotland emerging as key DC growth market

According to new analysis by Lichfields, Scotland’s combination of renewable energy, available land, and skilled talent is creating strong interest among developers assessing new large-scale data centre projects.

The study by the UK planning and development consultancy highlights how the UK’s data centre industry currently contributes around £4.7 billion to the economy each year, with forecasts suggesting a further £44 billion could be added by 2035 through construction and operation.

Scotland is well placed to capture a significant share of that growth, producing 113% of its electricity consumption from renewables in 2022 and exporting surplus clean power to the grid.

Primed for large-scale projects

Lichfields’ analysis references a previous site-shortlisting exercise led by Scottish Futures Trust, Crown Estate Scotland, and Scottish Enterprise, which identified a range of potential locations including Aberdeen, Dundee, Fife, and parts of the Highlands, with the right combination of renewable capacity, land availability, and technical expertise.

However, most large-scale schemes remain concentrated in southern England, reflecting differences in planning support and grid capacity.

Dan Evans, Associate Director at Lichfields, says, “For developers, Scotland offers something few regions or countries can match: abundant low-carbon energy, space for expansion, and a strong engineering base.

"The combination of renewable generation, cool climate, and established technical skills creates ideal conditions for sustainable data centre operations.

“Across the UK, we’re seeing growing demand from investors and operators looking for sites that balance performance, cost, and environmental responsibility. Scotland’s renewable strength and land availability tick those boxes, but delivery confidence remains key.

"Developers need clarity on where projects will be supported and how long approvals will take. A consistent national position, backed by local planning frameworks, would make a real difference in turning interest into investment.”

What is needed

The analysis points to several practical measures to help maintain momentum, including allocating land for data centre development in new Local Development Plans, using Masterplan Consent Areas to simplify consents for complex or multi-use sites, and encouraging early coordination between planning authorities, developers, and energy providers.

It highlights the £3.9 billion regeneration of the former Ravenscraig steelworks in North Lanarkshire as evidence of growing confidence in Scotland’s potential.

The project, which includes one of the UK’s largest AI-ready data centres, will support around 2,000 long-term jobs and deliver a £1.2 billion construction boost, contributing an estimated 0.4% to Scotland’s GDP each year once operational.

Dan continues, “Scotland has an opportunity to position itself as a genuine alternative to traditional UK data centre clusters. By combining its renewable capacity with a more agile planning approach, it can attract long-term global investment, create skilled employment, and strengthen its reputation for sustainable growth.

“Developers are ready to commit where policy, infrastructure, and delivery are properly coordinated. With the right signals from government and local authorities, Scotland could move from potential to performance very quickly.”

Joe Peck - 11 November 2025

Data Centre Build News & Insights

Data Centre Projects: Infrastructure Builds, Innovations & Updates

News

Equinix to build new $22m data centre in Lagos, Nigeria

Digital infrastructure company Equinix today announced its intention to open its latest high performance data centre in Lagos, Nigeria.

The $22 million (£16.7 million) investment in LG3 marks the first phase of an ambitious investment plan of around $100 million (£75.9 million) aimed at transforming Africa’s digital landscape over the next two years.

Set to open in Q1 2026, the site will deliver new infrastructure to Nigeria, empowering local businesses to scale while aiming to draw international companies to the country in this strategically positioned hub for global connectivity.

The addition of the new LG3 data centre in Nigeria also brings the incorporation of Network-as-a-Service platform Equinix Fabric into the metro, enabling businesses to connect their physical and virtual infrastructure to other Equinix locations all around the world.

Bridging Africa’s digital divide

Wole Abu, Managing Director for West Africa at Equinix, comments, “LG3 marks a significant milestone in Equinix’s long-term commitment to bridging Africa’s digital divide.

“As Lagos emerges at the crossroads of talent, innovation, and global connectivity, this facility is accelerating access to technologies like cloud, AI, and the next wave of startups."

Olawale Owoeye, Managing Director at Cedarview, adds, "Equinix’s Lagos data centre will provide us with the robust and resilient platform our customers demand to expand our digital footprint.

"The unparalleled reliability and access to a global ecosystem empower us to deliver high performance solutions to our customers, and the new LG3 data centre in Lagos is [a] key step in ensuring we remain at the forefront of businesses connecting Africa."

Nigeria is the second-largest economy in Sub-Saharan Africa. Lagos, in particular, is at the epicentre of Africa’s digital transformation, recognised as the only African city in the Global Top 100 Startup Ecosystems.

Expansion opportunities

Commenting on the opportunity for Equinix in Africa, Aslıhan Güreşcier, Vice President, EMEA Growth & Emerging Markets at Equinix, says, “Africa’s digital transformation is accelerating, driven by a young population, rising internet access, and increasing demand for secure data infrastructure.

"With the opening of our newest data centre in Lagos, Equinix is proud to invest in this dynamic region, supporting our customers’ growth with world-class data centres that power everything from banking and education to emergency services and commerce.”

Since entering the African market in 2022, Equinix has expanded its presence in key African markets including, Nigeria, Ghana, and Ivory Coast (Côte d’Ivoire). Last year, the company also opened its first data centre in Johannesburg, South Africa.

With a footprint spanning over 270 data centres worldwide, Equinix says it is continuing to bring its global expertise and infrastructure to the region, including harnessing Nigeria’s strategic position as an international hub for global subsea cable connections, linking Africa with Europe, Asia, and beyond.

For more from Equinix, click here.

Joe Peck - 10 November 2025

Data Centre Infrastructure News & Trends

Innovations in Data Center Power and Cooling Solutions

News

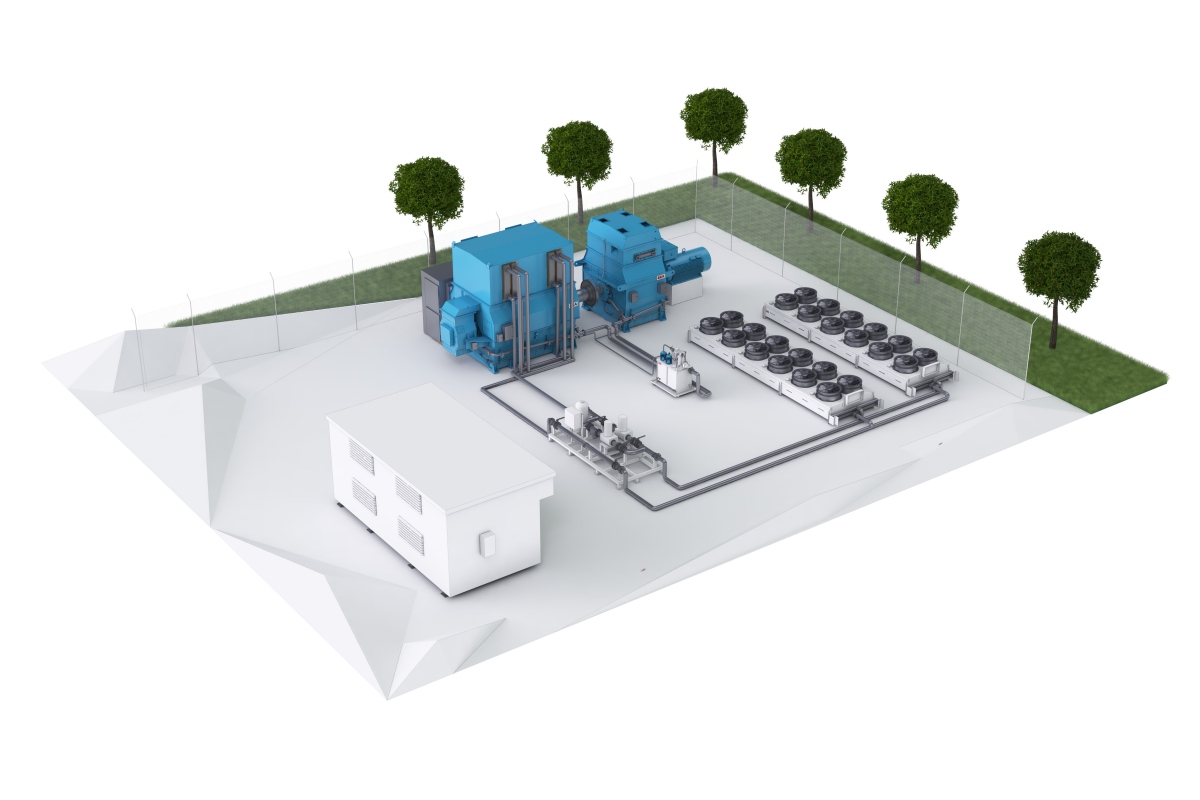

ABB, VoltaGrid to strengthen power stability for AI expansion

ABB, a multinational corporation specialising in industrial automation and electrification products, has secured three new orders from VoltaGrid, a Texas-based microgrid power generation company, to provide grid stabilisation technology supporting data centres across the United States.

The projects will supply stable and reliable electricity to facilities currently under construction for AI infrastructure. The contracts were booked during the first three quarters of 2025; financial details were not disclosed.

Strengthening grid resilience for AI-driven demand

To meet the growing power needs of data centres, ABB will deliver a package of 27 synchronous condensers with flywheels and prefabricated eHouse units. These include power control, automation, and excitation systems integrated into the synchronous condenser panels.

The units deliver instantaneous inertia, support short-circuit faults, and regulate network voltage by supplying or absorbing reactive power, helping maintain grid stability as electricity demand increases.

VoltaGrid will provide its natural-gas-fuelled power systems, designed for rapid deployment and to meet the specific power requirements of hyperscale data centres.

Project delivery will begin in December 2025, with the first systems expected to be operational by April 2026.

Nathan Ough, CEO of VoltaGrid, claims, “ABB’s synchronous condensers are vital for meeting the energy demands of next-generation technologies like AI data centres, thanks to their proven ability to ensure grid stability and enhance overall power system resilience.

"Partnering with ABB allows us to accelerate project execution and meet the growing performance demands of AI operations.”

Supporting the evolving data centre power ecosystem

According to recent estimates, data centres accounted for around 1.5% of global electricity consumption in 2024, with the United States responsible for 45% of that total.

By 2030, US data centre power use is projected to represent almost half of the country’s total growth in electricity demand. Analysts predict that, by the same year, the US will consume more electricity for data processing than for manufacturing energy-intensive materials such as aluminium, steel, cement, and chemicals.

As global demand for AI and cloud computing accelerates, ABB says it continues to provide electrification, automation, and digital technologies to "ensure secure and efficient energy systems for data centre operators."

Per Erik Holsten, President of ABB’s Energy Industries division, says, “ABB is proud to partner with VoltaGrid and support the evolving energy ecosystem in the US.

"Data centres have become critical national infrastructure and maintaining grid stability has moved from being optional to essential. Reliable, efficient power generation is key to enabling their continued growth.”

Kristina Carlquist, Head of the Synchronous Condenser Product Line at ABB’s Motion High Power division, adds, “Although synchronous condensers resemble large motors or generators, their real strength lies in grid support.

"As data centres expand, these machines are becoming increasingly important for providing inertia and short-circuit strength. For VoltaGrid, they will help ensure stable and resilient microgrid operation.”

For more from ABB, click here.

Joe Peck - 10 November 2025

Data Centre Infrastructure News & Trends

Innovations in Data Center Power and Cooling Solutions

Liquid Cooling Technologies Driving Data Centre Efficiency

Products

Vertiv expands immersion liquid cooling portfolio

Vertiv, a global provider of critical digital infrastructure, has introduced the Vertiv CoolCenter Immersion cooling system, expanding its liquid cooling portfolio to support AI and high-performance computing (HPC) environments. The system is available now in Europe, the Middle East, and Africa (EMEA).

Immersion cooling submerges entire servers in a dielectric liquid, providing efficient and uniform heat removal across all components. This is particularly effective for systems where power densities and thermal loads exceed the limits of traditional air-cooling methods.

Vertiv has designed its CoolCenter Immersion product as a "complete liquid-cooling architecture", aiming to enable reliable heat removal for dense compute ranging from 25 kW to 240 kW per system.

Sam Bainborough, EMEA Vice President of Thermal Business at Vertiv, explains, “Immersion cooling is playing an increasingly important role as AI and HPC deployments push thermal limits far beyond what conventional systems can handle.

“With the Vertiv CoolCenter Immersion, we’re applying decades of liquid-cooling expertise to deliver fully engineered systems that handle extreme heat densities safely and efficiently, giving operators a practical path to scale AI infrastructure without compromising reliability or serviceability.”

Product features

The Vertiv CoolCenter Immersion is available in multiple configurations, including self-contained and multi-tank options, with cooling capacities from 25 kW to 240 kW.

Each system includes an internal or external liquid tank, coolant distribution unit (CDU), temperature sensors, variable-speed pumps, and fluid piping, all intended to deliver precise temperature control and consistent thermal performance.

Vertiv says that dual power supplies and redundant pumps provide high cooling availability, while integrated monitoring sensors, a nine-inch touchscreen, and building management system (BMS) connectivity simplify operation and system visibility.

The system’s design also enables heat reuse opportunities, supporting more efficient thermal management strategies across facilities and aligning with broader energy-efficiency objectives.

For more from Vertiv, click here.

Joe Peck - 7 November 2025

Data Centre Build News & Insights

Data Centre Projects: Infrastructure Builds, Innovations & Updates

Data Centres

News

Colt DCS to expand West London hyperscale campus

Colt Data Centre Services (Colt DCS), a global provider of AI, hyperscale, and large enterprise data centres, has announced that it has received committee approval (Resolution to Grant) from Hillingdon Council to expand its Hayes Digital Park campus in West London with three new hyperscale data centres and an Innovation Hub.

The £2.5 billion investment will strengthen the UK’s digital infrastructure, support the government’s modern industrial strategy, and help drive the nation’s growing AI economy.

The three new hyperscale data centres - London 6, 7, and 8 - will be powered using 100% renewable energy through a Power Purchase Agreement (PPA). Power contracts for this development have been secured with National Grid and a high voltage supply is due to be delivered by October 2027. The expansion will add an additional 97MW to the available IT power at the Hayes Digital Park, taking the total capacity to 160MW. Construction is expected to start in mid-2026, with the first data centre (London 6) scheduled to go live in early 2029. Once operational, the new facilities will create over 500 permanent jobs, training more than 50 technical apprentices over a 10-year build programme.

In addition to the data centres, Colt DCS will develop an Innovation Hub in partnership with Brunel University, designed to serve as a community space and incubator for digital start-ups. The hub will promote economic synergy by co-locating light-industrial and digital innovation businesses, creating opportunities for collaboration, research, and skills development within an affordable workspace. Students from Brunel University will be encouraged to use the hub to develop entrepreneurial projects and technology-led ventures to support the digital economy.

AECOM has been appointed to develop the design proposals for the Innovation Hub. The facility aims to act as a base for innovation and community engagement, with flexible space for future industrial use, in line with planning policy for Strategic Industrial Land. It will also provide social value by hosting local events themed around culture, food, film, music, and literature.

The new development will also deliver a district heating network, using waste heat from the data centres to support local businesses, communities, and residential buildings. Under the planning permission, back-up generators will only be permitted to operate for a maximum of 15 hours per year, with the data centres powered directly from the national grid.

“This announcement marks another important milestone for the UK’s digital economy,” says Xavier Matagne, Chief Real Estate Officer at Colt DCS. “Data centres are a cornerstone of digital transformation. With this expansion, we can help power innovation, support the AI revolution, and contribute to the energy transition.”

Xavier continues, “Our new campus in Hayes, including the Innovation Hub in partnership with Brunel University, will drive community value, from reusing heat for district heating to creating jobs, skills, and long-term investment. As one of the few operators capable of delivering new capacity in this area of London over the next decade, we’re proud to be helping power the UK’s future economy in a sustainable and inclusive way.”

Cllr Steve Tuckwell, Hillingdon Council's Cabinet Member for Planning, Housing and Growth, notes, "Hillingdon is open for business, and we're working closely with our business community, new and existing investors and partners to drive innovation and development in the right places.

"The innovation hub is an exciting new development that will help to foster economic growth. It will help to equip residents and smaller local businesses with the right skills, affordable workspaces, and opportunities to thrive.

"Hayes is playing a leading role in shaping London's digital economy and infrastructure and it's vital local people have more opportunities to experience the benefits."

For more from Colt DCS, click here.

Simon Rowley - 5 November 2025

Data Centre Infrastructure News & Trends

Exclusive

Innovations in Data Center Power and Cooling Solutions

Liquid Cooling Technologies Driving Data Centre Efficiency

CDUs: The brains of direct liquid cooling

As air cooling reaches its limits with AI and HPC workloads exceeding 100 kW per rack, hybrid liquid cooling is becoming essential. To this, coolant distribution units (CDUs) could be the key enabler for next-generation, high-density data centre facilities.

In this article for DCNN, Gordon Johnson, Senior CFD Manager at Subzero Engineering, discusses further the importance of CDUs in direct liquid cooling:

Cooling and the future of data centres

Traditional air cooling has hit its limits, with rack power densities surpassing 100 kW due to the relentless growth of AI and high-performance computing (HPC) workloads. Already, CPUs and GPUs exceed 700–1000 W per socket, while projections estimate that to rise to over 1500 W going forward.

Fans and heat sinks are just unable to handle these thermal loads at scale. Hybrid cooling strategies are becoming the only scalable, sustainable path forward.

Single-phase direct-to-chip (DTC) liquid cooling has emerged as the most practical and serviceable solution, delivering coolant directly to cold plates attached to processors and accelerators. However, direct liquid cooling (DLC) cannot be scaled safely or efficiently with plumbing alone. The key enabler is the coolant distribution unit (CDU), a system that integrates pumps, heat exchangers, sensors, and control logic into a coordinated package.

CDUs are often mistaken for passive infrastructure. But far from being a passive subsystem, they act as the brains of DLC, orchestrating isolation, stability, adaptability, and efficiency to make DTC viable at data centre scale. They serve as the intelligent control layer for the entire thermal management system.

Intelligent orchestration

CDUs do a lot more than just transport fluid around the cooling system; they think, adapt, and protect the liquid cooling portion of the hybrid cooling system. They maintain redundancy to ensure continuous operation, control flow, and pressure, using automated valves and variable speed pumps, filtering particulates to protect cold plates, and maintaining coolant temperature above the dew point to prevent condensation. They contribute to the precise, intelligent, and flexible coordination of the complete thermal management system.

Because of their greater cooling capacity, CDUs are ideal for large HPC data centres. However, because they must be connected to the facility's chilled water supply or another heat rejection source to continuously provide liquid to the cold plates for cooling, they can be complicated.

CDUs typically fall into two categories:

• Liquid to Liquid (L2L): Large HPC facilities are well-suited for high-capacity CDUs known as L2L. Through heat exchangers, they move chip heat into the isolated chilled water loop, such as the facility water system (FWS).

• Liquid to Air (L2A): For smaller deployments, L2A CDUs are simpler but have a lower cooling capacity. By utilising conventional HVAC systems, they transfer heat from the returning liquid coolant from the cold plates to the surrounding data centre air by using liquid-to-air heat exchangers rather than a chilled water supply or FWS.

Isolation: Safeguarding IT from facility water

Acting as the bridge between the FWS and the dedicated technology cooling system (TCS), which provides filtered liquid coolant directly to the chips via cold plate, CDUs isolate sensitive server cold plates from external variability, ensuring a safe and stable environment while constantly adjusting to shifting workloads.

One of L2L CDUs' primary functions is to create a dual-loop architecture:

• Primary loop (facility side): Connects to building chilled water, district cooling, or dry coolers

• Secondary loop (IT side): Delivers conditioned coolant directly to IT racks

CDUs isolate the primary loop (which may carry contaminants, particulates, scaling agents, or chemical treatments like biocides and corrosion inhibitors - chemistry that is incompatible with IT gear) from the secondary loop. As well as preventing corrosion and fouling, this isolation offers operators the safety margin that operators need for board-level confidence in liquid.

The integrity of the server cold plates is safeguarded by the CDU, which uses a heat exchanger to separate the two environments and maintain a clean, controlled fluid in the IT loop. Because CDUs are fitted with variable speed pumps, automated valves, and sensors, they can dynamically adjust the flow rate and pressure of the TCS to ensure optimal cooling even when HPC workloads change.

Stability: Balancing thermal predictability with unpredictable loads

HPC and AI workloads are not only high power; they are also volatile. GPU-intensive training jobs or changeable CPU workloads can cause high-frequency power swings, which - without regulation - would translate into thermal instability. The CDU mitigates this risk by controlling temperature, pressure, and flow across all racks and nodes, absorbing dynamic changes and delivering predictable thermal conditions.

The CDU absorbs fluctuations by stabilising temperature, pressure, and flow across all racks and nodes, regardless of how erratic the workload is. Sensor arrays ensure the cooling loop remains in accordance with specifications, while variable speed pumps modify flow to fit demand and heat exchangers are calibrated to maintain an established approach temperature.

Adaptability: Bridging facility constraints with IT requirements

The thermal architecture of data centres varies widely, with some using warm-water loops that operate at temperatures between 20 and 40°C. By adjusting secondary loop conditions to align IT requirements with the facility, the CDU adjusts to these fluctuations. The CDU uses mixing or bypass control to temper supply water. It can alternate between tower-assisted cooling, free cooling, or dry cooler rejection depending on the environmental conditions, and it can adjust flow distribution amongst racks to align with real-time demand.

This adaptability makes DTC deployable in a variety of infrastructures without requiring extensive facility renovations. It also makes it possible for liquid cooling to be phased in gradually - ideal for operators who need to make incremental upgrades.

Efficiency: Enabling sustainable scale

Beyond risk and reliability, CDUs unlock possibilities that make liquid cooling a sustainable option.

By managing flow and temperature, CDUs eliminate the inefficiencies of over-pumping and over-cooling. They also maximise scope for free cooling and heat recovery integration such as connecting to district heating networks and reclaiming waste heat as a revenue stream or sustainability benefit. This allows operators to simultaneously lower PUE (Power Usage Effectiveness) to values below 1.1 while simultaneously reducing WUE (Water Usage Effectiveness) by minimising evaporative cooling. All this, while meeting the extreme thermal demands of AI and HPC workloads.

CDUs as the thermal control plane

Viewed holistically, CDUs are far more than pumps and pipes; they are the thermal control plane for thermal management, orchestrating safe isolation, dynamic stability, infrastructure adaptability, and operational efficiency.

They translate unpredictable IT loads into manageable facility-side conditions, ensuring that single-phase DTC can be deployed at scale, enabling HPC and AI data centres to evolve into multi-hundred kilowatt racks without thermal failure.

Without CDUs, direct-to-chip cooling would be risky, uncoordinated, and inefficient. With CDUs, it becomes an intelligent and resilient architecture capable of supporting 100 kW (and higher) racks as well as the escalating thermal demands of AI and HPC clusters.

As workloads continue to climb and rack power densities surge, the industry’s ability to scale hinges on this intelligence. CDUs are not a supporting component; they are the enabler of single-phase DTC at scale and a cornerstone of the future data centre.

For more from Subzero Engineering, click here.

Joe Peck - 4 November 2025

Head office & Accounts:

Suite 14, 6-8 Revenge Road, Lordswood

Kent ME5 8UD

T: +44 (0)1634 673163

F: +44 (0)1634 673173