Omdia research defines key characteristics of sovereign cloud for enterprise

Author: Isha Jain

Analysis undertaken by Omdia has revealed that the approach to sovereign cloud by the leading vendors is as diverse as people’s understanding of what sovereign cloud is.

The term sovereign cloud is a nebulous concept that means different things to different people. At its heart, it is about being compliant with the local regulations and laws of the country being operated in, with respect to how data is stored, processed, and who has access to it.

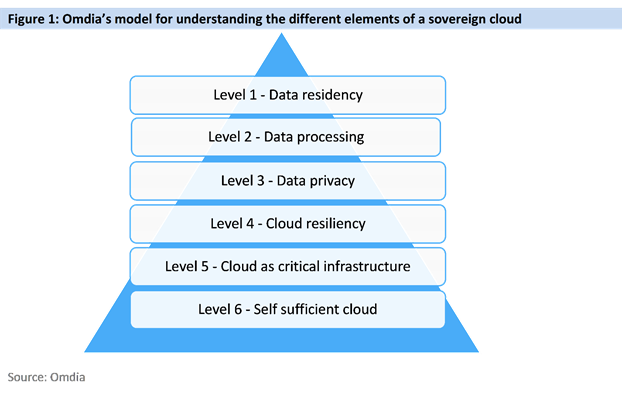

Omdia has developed a six-level model that defines the broad different technical aspects attributed to sovereign cloud. Each country will apply different levels to the specific regulations and laws they pass, and it is this flexibility that characterises the market for sovereign cloud.

The vendors with solutions in this space have selected to approach it in two different ways. Firstly, there is the sovereign by design school – where the architecture of the solution enables the vendor to offer sovereign cloud capabilities using its existing footprint. Secondly, there is the built to be sovereign school – where the vendors have taken an existing capability and specifically built a new offering that addresses some of the questions the sovereign by design school does not fully address.

“While the motivation and approaches differ to delivering sovereign cloud, there is a common acceptance that it is not something the large vendors can do alone. The use of local trusted partners is key to any delivery strategy, but this use must be designed so that it meets the requirements, particularly delivering a cloud that is free from extraterritorial access. While much of the focus is on how any sovereign cloud will operate in Europe, that is not the only potential market, and vendors need to build solutions that are repeatable globally based on the different requirements the different geographies have,” says Roy Illsley, Chief Analyst and Lead of Omdia’s IT Operations Research Practice. “Vendors as diverse as AWS, Microsoft, Google, Oracle, IBM, VMware, NetApp, and OVHCloud are already offering sovereign clouds with these capabilities.”

In a customer survey undertaken to support this piece of research, Omdia cloud services survey – 2023, it found that by the end of 2023 more than 70% of organisations have plans to adopt some form of sovereign cloud. The survey also demonstrated that the end users of a sovereign cloud have multiple different reasons for using it. The top two reasons respondents reported were, ‘data processing must be performed in country’ (29%) and ‘only residents of the country should be able to access the data’ (28%). These relate to level two and level three of the model, with ‘data residency’ (level one) third (24%) and only 18% selected level four resiliency.

“Interestingly, EMEA is not the largest user of sovereign cloud currently, it is the lowest user, with only 25% of respondents, while Asia and Oceania report, 36% are currently using sovereign cloud, and 31% in North America. However, if the intentions are converted to actual usage, then by the end of 2023, Asia and Oceania will remain the largest market with 74% using sovereign cloud, followed by North America at 70%, and EMEA at 65%. However, these results must be cognisant of the fact the EMEA respondents were from a range of countries across the region and include a majority from non-EU countries, which can explain its low adoption figures, while North America must follow different state regulations particularly in relation to gambling regulations,” says Vlad Galabov, Research Director at Omdia’s Cloud and Data Centre Research Practice.

One aspect of sovereign cloud that needs to be discussed is the commercial viability of any solution. By its very nature, a sovereign cloud will be specific to a country, and while there may be common features, some technical aspects may be very local. It is also worth noting that Omdia does not expect every workload or all the data to be considered as requiring a sovereign solution. Therefore, understanding the size of the market for the type of sovereign cloud being offered, and how repeatable this is, are key understandings that are yet to be established.

The emergence of generative AI and the ability of companies to produce company specific models trained on its own data using one of the foundational models introduces another aspect of sovereign cloud that will need to be addressed.

Cloud service providers were pointed out as the vertical that is most likely to deliver these sovereign solutions, but the research also found that data companies have solutions that could address the sovereign requirements. As with the software infrastructure vendors, Omdia considers that these two groups along with the OEM vendors could develop on-premises solutions that would be able to be configured for each specific use case. The big question for sovereign cloud is, will it remain a public cloud or will it revert to a private cloud? The answer is unknown, but the company expects to see these two groups, cloud service providers and OEMs and partners to market its specific strengths in relation to meeting the requirements.

“It will become a question of balancing the risk, agility and cost equation as there is no absolute perfect solution. Rather it is the solution that the customer believes fits its needs and meets its budget,” concludes Roy.

Click here for more latest news.