Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Artificial Intelligence in Data Centre Operations

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Data Centre Security: Protecting Infrastructure from Physical and Cyber Threats

Security Risk Management for Data Centre Infrastructure

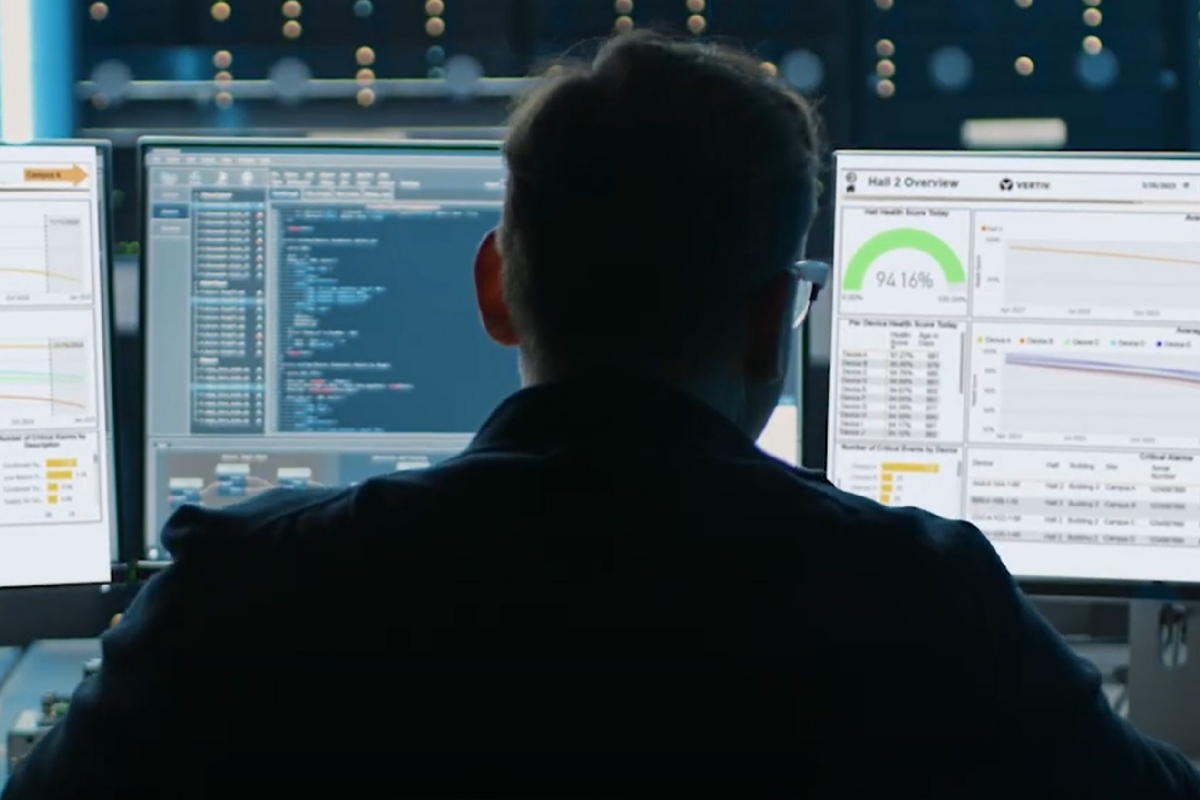

Vertiv launches AI predictive maintenance service

Vertiv, a global provider of critical digital infrastructure, has launched a new AI-powered predictive maintenance service, Vertiv Next Predict, aimed at modern data centres and facilities supporting AI workloads, including AI factories.

The managed service is designed to move maintenance away from time-based and reactive models, using data analysis to identify potential issues before they affect operations.

Vertiv says the service supports power, cooling, and IT systems with the aim of improving visibility and supporting more consistent infrastructure performance.

The company notes that, as AI workloads increase compute intensity, data centre operators are under pressure to maintain uptime and performance across increasingly complex environments. In this respect, predictive maintenance and advanced analytics are positioned as a way to support more informed operational decisions.

Ryan Jarvis, Vice President of the Global Services Business Unit at Vertiv, says, “Data centre operators need innovative technologies to stay ahead of potential risks as compute intensity rises and infrastructures evolve.

“Vertiv Next Predict helps data centres unlock uptime, shifting maintenance from traditional calendar-based routines to a proactive, data-driven strategy. We move from assumptions to informed decisions by continuously monitoring equipment condition and enabling risk mitigation before potential impacts to operations.”

AI-based monitoring and anomaly detection

Vertiv Next Predict uses AI-based anomaly detection to analyse operating conditions and identify deviations from expected behaviour at an early stage. A predictive algorithm then assesses potential operational impact to determine risk and prioritise responses.

The service also includes root cause analysis to help isolate contributing factors, supporting more targeted resolution. Based on system data and site context, prescriptive actions are defined and carried through to execution, with corrective measures carried out by Vertiv Services personnel.

According to Vertiv, this approach is intended to support earlier intervention and reduce the likelihood of unplanned outages by addressing issues before they escalate.

The service currently supports a range of Vertiv power and cooling platforms, including battery energy storage systems (BESS) and liquid cooling components. Vertiv says the platform is designed to expand over time to support additional technologies as data centre infrastructure evolves.

Vertiv Next Predict is intended to integrate as part of a broader grid-to-chip service architecture, with the aim of supporting long-term scalability and alignment with future data centre technologies.

For more from Vertiv, click here.

Joe Peck - 27 January 2026

Data Centre Build News & Insights

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Data Centre Projects: Infrastructure Builds, Innovations & Updates

Hyperscale Data Centres: Scale, Speed & Strategy

McCarthy tops out NV12 project at Vantage’s campus

General contractor McCarthy Building Companies recently completed the topping out milestone for hyperscale data centre provider Vantage Data Centers’ second of four planned data centres on its NV1 Campus, located outside of Reno in Storey County, Nevada, USA.

With representatives from Storey County and Vantage leadership in attendance, the project marked major progress on the NV12 facility, the second 64-megawatt (MW) data centre on the campus.

Phase I of the campus provides hyperscalers and large cloud providers with 128 MW of combined critical IT capacity across its NV11 and NV12 facilities. The campus has reportedly created more than 1,200 local construction jobs and generated local economic impact.

McCarthy notes that, just recently, the campus reached more than 1.1 million labour hours on site since breaking ground in May 2024, with zero lost-time incidents through what it describes as a "campus-wide commitment to safe construction practices and innovative methods."

Austin Osborne, Storey County Manager, explains, “Vantage Data Centers, our developer partners; McCarthy Building Companies, the general contractor on site; and the Storey County team - from Community Development and Planning to Business Development and the Fire Protection District - have worked closely to move this project forward.

"It’s a strong example of effective collaboration, and we’re grateful for the long-term opportunities this project will continue to bring to our community.”

The 260,000ft² (24,155m²), two-storey NV12 facility utilises liquid-to-liquid cooling, similar to NV11, that operates on a closed loop chilled water system to properly cool the systems while requiring only an initial fill.

This more sustainable design is common across Vantage’s data centres, with the company noting it represents its "commitment to sustainable operations and long-term reliability."

Continued construction during ongoing operation

Jared Carlson, Senior Vice President at McCarthy Building Companies, comments, “This project has demonstrated an incredible commitment to sustainability, safe construction, and operations, and has created a strong sense of community within Storey County.

"Vantage and our design-build partners have been instrumental in creating a campus that will provide significant economic impact to the region and will continue to sustain technological growth in the years to come.”

Following turnover of NV11, NV12 will begin to turn over phased portions of the facility beginning in December 2027, allowing customers to begin operations prior to final completion in early 2029.

As construction progress continues, McCarthy will be piloting the use of an HP Robot to map out the layout of NV12’s walls, blockouts, and backing.

Following the robot’s success on some of McCarthy's healthcare projects, the team will use the robot to layout all elements on the concrete slab, based on the existing Building Information Model (BIM) layout.

This method allows for greater efficiency and precision as the facility’s core components have already been digitally modelled to the site’s conditions.Both NV11 and NV12 are being constructed by McCarthy in a design-build effort with Corgan, serving as the campus architect. Key design-build trade partners include: Amfabsteel, Chavez-Grieves, Rosendin Electric, Apollo Mechanical Contractors, Salas O’Brien, Integrated Fire and Security Solutions, Cosco Fire Protection, and Wood Rogers.

For more from Vantage, click here.

Joe Peck - 23 January 2026

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Hyperscale Data Centres: Scale, Speed & Strategy

News

Report: How Slough became Europe's largest DC cluster

Kao Data, a developer and operator of data centres engineered for AI and advanced computing, has published a new report examining how Slough has evolved into Europe’s largest data centre cluster - and the UK’s de facto AI Growth Zone (AIGZ) - hosting over 675 Megawatts (MW) of hyperscale data centre capacity, while contributing more than 14,000 jobs and over £30 million in annual business rates to the local economy.

The new report, ‘The Quiet Revolution: How Data Centres Remade Slough and Secured the UK’s Digital Future’, was released just as the UK marks 12 months since the inception of the Government’s AI Opportunities Action Plan, which proposed the creation of AIGZs to accelerate infrastructure deployments in support of the country’s AI and economic ambitions.

Kao Data’s new report, produced with support from Carbon3IT and Parisi, demonstrates that such a growth zone already exists in Slough, operating at around 1GW of capacity and providing a proven blueprint for regional, economic growth.

Further, it highlights the positive contribution that data centres - often incorrectly maligned as an industry which creates minimal jobs and economic impact - can have on a local community.

For example, the report reveals that data centres replaced declining manufacturing employment in the Slough region on a near one-to-one basis, and created approximately 8,000 construction jobs between 2010 and 2025, alongside hundreds of permanently skilled operational roles.

Other key findings

• Slough hosts more than 30 operational data centres with around 1GW of total capacity, including 675MW of hyperscale facilities serving UK availability zones.

• The cluster supports approximately 14,000 jobs across direct, indirect, and induced employment.

• Data centre operators contribute over £30 million per year in local business rates.

• 95% of Slough’s data centre electricity demand is backed by 100% renewable procurement.

• The Simplified Planning Zone (SPZ) framework generated £18 million in council revenues between 2014 and 2024.

• Nearly 2.7 million people with engineering, construction, and telecommunications experience live within one hour of the Slough Trading Estate.

Spencer Lamb, MD & Chief Commercial Officer at Kao Data, explains, “Slough shows, in very real terms, what happens when infrastructure is developed with planning certainty, energy availability, and a skilled workforce, and our new report demonstrates that data centres have delivered long-term job creation, significant tax revenues, and a resilient foundation for the UK’s AI and digital economies.

“We firmly believe that data centres are a force for good in this country, providing well-paid, varied, and future-proof employment, economic regeneration to post-industrial areas, and, through operator-led energy procurement, are helping transition the UK to a green economy.”

With Slough and West London’s grid constraints well documented, the economic case for developing additional regional hubs in the UK has never been more urgent.

Moreover, with data centres now designated as Critical National Infrastructure (CNI), the report concludes that the UK must create additional clusters across the country to propel regional economic growth and provide security diversity.

With Slough proving what's possible when the conditions and local governance are right, the task now is to build on that success deliberately, regionally, and at scale - starting with the UK’s AIGZs and existing city tech communities like Greater Manchester - so that Britain's AI and digital economies can be powerful and resilient.

For more from Kao Data, click here.

Joe Peck - 22 January 2026

Data Centre Infrastructure News & Trends

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Innovations in Data Center Power and Cooling Solutions

Modular Data Centres in the UK: Scalable, Smart Infrastructure

Prism expands into the US market

Prism Power Group, a UK manufacturer of electrical switchgear and critical power systems for data centres, is looking to purchase a US business that already has UL Certification (for compliance, safety, and quality assurance regulations) and is reportedly raising $40 million (£29.8 million) for the acquisition.

With surging data centre demand straining power infrastructure and outpacing domestic capacity, US developers are actively seeking trusted overseas suppliers to keep pace.

Prism says it is well placed to take advantage of the current climate, having forged its reputation in mechanical and electrical infrastructure for modular data centre initiatives in the UK and across Europe since 2005.

It adds that its engineers have executed a variety of end-to-end installations, from high-voltage substations and backup generators to low-voltage switchboards that safeguard servers, in "tightly scheduled" data centre projects.

Expansion to meet ongoing supply strain

Adhum Carter Wolde-Lule, Director at Prism Power Group, explains, “The scale and urgency is such that America’s data centre expansion has become an international endeavour, and we’re again able to punch well above our weight in providing the niche expertise that’s missing and will augment strained local supply chains on the ground, straight away.

“Major power manufacturers in the United States are ramping up production, while global giants have announced new stateside factories for transformers and switchgear components, aiming to cut lead times and ease the backlog - but those investments will take years to bear fruit and that is time the US data centre market simply doesn’t have.”

Keith Hall, CEO at Prism Power Group, adds, “For overseas engineering companies like us [...], the time is now and represents an exceptional opening into the world’s fastest-growing infrastructure market.

"Equally, for the US sector, the willingness to look globally for critical power systems excellence will prove vital in keeping ambitious build-outs on schedule and preventing the data centre explosion from hitting a capacity wall.”

Joe Peck - 19 January 2026

Data Centre Build News & Insights

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Data Centre Projects: Infrastructure Builds, Innovations & Updates

Modular Data Centres in the UK: Scalable, Smart Infrastructure

SITE delivers modular DC on remote Atlantic island

Secure I.T. Environments (SITE), a UK design and build company for modular, containerised, and micro data centres, has announced the completion of a complex, modular, containerised data centre for a global telecommunications provider on a remote South Atlantic island.

The facility will support mission-critical ground operations connecting customers to next-generation satellite and subsea backbone services.

Located 1,800km west of mainland Africa, the remote island offers an effective operating profile for satellite connectivity, but presented formidable barriers including rugged volcanic terrain with no pre-existing access road, minimal local infrastructure, limited sea freight windows, and a single weekly flight subject to weather.

The brief demanded a resilient, high-capacity facility capable of continuous operation in a corrosive coastal climate, delivered with meticulous risk management and zero compromise on safety or performance.

Overcoming challenging logistics

One of the defining aspects of this project was the logistical coordination required not just across continents, but in partnership with the local community. The island’s small population meant that everyone from hotel owners to logistics workers became part of the project in some way.

The project created local employment opportunities and, the company says, fostered a sense of community pride in supporting a high-tech project.

Given the island's limited flight availability (one flight per week, weather permitting), all deliveries, personnel scheduling, and construction phases had to be meticulously timed. The team also had to navigate unpredictable weather, which could delay flights and shipping schedules.

A spokesperson for the client outlines, “This was such a crucial project for us. We did a huge amount of work ensuring we picked an experienced data centre builder that could cope with the challenges.

"SITE supported us throughout the design phase, adapted to meet our needs, and created a very detailed plan for delivery and installation, focused on minimising risks. We are very pleased with the outcome.”

SITE’s bespoke solution

Initial design discussions to final commissioning took 12 months and was completed on time.

SITE designed, manufactured, pre-built, and factory-tested a multi-container modular facility - comprising a main data room, a separate UPS/switch room, and lobby space - engineered specifically for the island’s conditions, including specially adapted air conditioning condensers, protective coatings, and materials to withstand high salinity levels and ocean spray.

The architecture integrates high-density IT racks with cold-aisle containment, N+1 energy-efficient cooling, modular N+1 UPS, custom switchgear, fire detection and suppression, security systems (CCTV, access control, intruder alarms), fibre raceways, and full electrical infrastructure.

All modules underwent integrated systems testing (IST) in the UK to ensure seamless on-site assembly and performance alignment once deployed.

Chris Wellfair, Projects Director at SITE, comments, “This was an extraordinary project in every sense: remote location, complex logistics, and high client expectations.

"Our modular approach and close collaboration with clients ensured a smooth delivery despite the odds. It’s a project we’re incredibly proud of.”

For more from SITE, click here.

Joe Peck - 14 January 2026

Data Centre Build News & Insights

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Data Centre Projects: Infrastructure Builds, Innovations & Updates

Modular Data Centres in the UK: Scalable, Smart Infrastructure

NorthC to build new data centre in Geneva

NorthC Group, a data centre operator in Northwest Europe, will begin construction of a new data centre in Geneva, Switzerland in Q1 of this year. The new facility will be built at The Hive campus, a technology park just outside Geneva.

This will be NorthC’s sixth data centre in Switzerland, in addition to its existing data centres in Biel (Bern), Winterthur (Zurich) and Münchenstein (Basel), as well as the recently announced and yet-to-be-built data centre on the uptownBasel campus in Arlesheim (Basel).

The total IT capacity will be 4.5 MW, delivered in phases of 1.5 MW, and the data centre will have a total floor area of 5,400 m², with construction expected to be completed by Q2 2028.

NorthC says it will prioritise sustainability in constructing the new data centre "by implementing innovative technologies." The facility will use 100% green power, consistent with all of NorthC's data centres, and its cooling system will require no water.

Additionally, backup generators will operate on HVO100, a fossil-free fuel made from renewable materials such as vegetable oils and waste fats.

Designed for AI

The new data centre will be designed to support emerging technologies (such as inference applications) through direct-to-chip (D2C) liquid cooling, which dissipates heat from computer chips more efficiently than traditional methods.

Alexandra Schless, CEO of NorthC Group, comments, “Geneva is an important commercial and economic hub in Switzerland, alongside the Basel and Zurich regions. Demand for digital services - and, consequently, for data centre capacity - is growing rapidly.

"This makes Geneva a logical location for NorthC to build a new data centre. The proximity to the renowned scientific research centre, CERN, also offers new opportunities for collaboration in scientific research and innovation, including AI.”

Modular design and readiness for residual heat exchange

The new Geneva data centre will be built according to NorthC’s standard blueprint design, which is based on modular construction, meaning additional modules can be added and activated as demand increases. This approach often results in more efficient energy consumption and enables rapid scaling.

The data centre will also have a direct, high-speed data connection to NorthC’s other locations in Switzerland, providing customers in the region with fast access to services running at other locations.

The construction, led by HIAG, a Swiss real estate developer, aims to ensure that the Geneva data centre is designed with sustainability at its core. Like almost all of NorthC's data centres, the Geneva facility will be prepared to support the exchange of residual heat.

At The Hive campus, where the data centre is being built, this heat will be used to supply nearby buildings. The facility is also being prepared for a potential future connection to the district heating network operated by the local energy company.

For more from NorthC, click here.

Joe Peck - 13 January 2026

Artificial Intelligence in Data Centre Operations

Data Centre Build News & Insights

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Exploring Modern Data Centre Design

Vertiv predicts data centre innovation trends

Data centre innovation is continuing to be shaped by macro forces and technology trends related to AI, according to a report from Vertiv, a global provider of critical digital infrastructure.

The Vertiv Frontiers report, which draws on expertise from across the organisation, details the technology trends driving current and future innovation, from powering up for AI to digital twins and adaptive liquid cooling.

Scott Armul, Chief Product and Technology Officer at Vertiv, says, “The data centre industry is continuing to rapidly evolve how it designs, builds, operates, and services data centres in response to the density and speed of deployment demands of AI factories.

“We see cross-technology forces, including extreme densification, driving transformative trends such as higher voltage DC power architectures and advanced liquid cooling that are important to deliver the gigawatt scaling that is critical for AI innovation.

"On-site energy generation and digital twin technology are also expected to help advance the scale and speed of AI adoption.”

The Vertiv Frontiers report builds on and expands Vertiv’s previous annual Data Centre Trends predictions. The report identifies macro forces driving data centre innovation. These include:

• Extreme densification — accelerated by AI and HPC workloads• Gigawatt scaling at speed — with data centres now being deployed rapidly and at unprecedented scale• Data centre as a unit of compute — as the AI era requires facilities to be built and operated as a single system• Silicon diversification — noting data centre infrastructure must adapt to an increasing range of chips and compute

The report details how these macro forces have in turn shaped five key trends impacting specific areas of the data centre landscape:

1. Powering up for AI

Most current data centres still rely on hybrid AC/DC power distribution from the grid to the IT racks, which includes three to four conversion stages and some inefficiencies. This existing approach is under strain as power densities increase, largely driven by AI workloads.

The shift to higher voltage DC architectures enables significant reductions in current, size of conductors, and number of conversion stages while centralising power conversion at the room level.

Hybrid AC and DC systems are pervasive, but as full DC standards and equipment mature, higher voltage DC is likely to become more prevalent as rack densities increase.

On-site generation - and microgrids - will also drive adoption of higher voltage DC.

2. Distributed AI

The billions of dollars invested into AI data centres to support large language models (LLMs) to date have been aimed at supporting widespread adoption of AI tools by consumers and businesses.

Vertiv believes AI is becoming increasingly critical to businesses, but how - and from where - those inference services are delivered will depend on the specific requirements and conditions of the organisation.

While this will impact businesses of all types, highly regulated industries (such as finance, defence, and healthcare) may need to maintain private or hybrid AI environments via on-premise data centres, due to data residency, security, or latency requirements.

Flexible, scalable high-density power and liquid cooling systems could enable capacity through new builds or retrofitting of existing facilities.

3. Energy autonomy accelerates

Short-term, on-site energy generation capacity has been essential for most standalone data centres for decades to support resiliency. However, widespread power availability challenges are creating conditions to adopt extended energy autonomy, especially for AI data centres.

Investment in on-site power generation, via natural gas turbines and other technologies, does have several intrinsic benefits but is primarily driven by power availability challenges.

Technology strategies such as 'Bring Your Own Power (and Cooling)' are likely to be part of ongoing energy autonomy plans.

4. Digital twin-driven design and operations

With increasingly dense AI workloads and more powerful GPUs also comes a demand to deploy these complex AI factories with speed.

Using AI-based tools, data centres can be mapped and specified virtually - via digital twins - and the IT and critical digital infrastructure can be integrated, often as prefabricated modular designs, and deployed as units of compute, reducing time-to-token by up to 50%.

This approach will be important to efficiently achieving the gigawatt-scale buildouts required for future AI advancements.

5. Adaptive, resilient liquid cooling

AI workloads and infrastructure have accelerated the adoption of liquid cooling, but, conversely, AI can also be used to further refine and optimise liquid cooling solutions.

Liquid cooling has become mission-critical for a growing number of operators, but AI could provide ways to further enhance its capabilities. AI, in conjunction with additional monitoring and control systems, has the potential to make liquid cooling systems smarter and even more robust by predicting potential failures and effectively managing fluid and components.

This trend should lead to increasing reliability and uptime for high value hardware and associated data/workloads.

For more from Vertiv, click here.

Joe Peck - 12 January 2026

Data Centre Build News & Insights

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Data Centre Projects: Infrastructure Builds, Innovations & Updates

Edge Computing in Modern Data Centre Operations

Duos Edge AI deploys edge DC in Abilene, Texas

Duos Technologies Group, through its subsidiary Duos Edge AI, a provider of edge data centre (EDC) systems, has deployed a new edge data centre in Abilene, Texas, in partnership with Region 14 Education Service Center.

The facility forms part of the company’s ongoing rollout of carrier neutral edge data centres across Texas and is intended to support education, healthcare, workforce development, and local businesses.

Expanding regional edge infrastructure

Located at Region 14 ESC, the data centre will act as a local colocation site and computing hub for more than 40 school districts and charter schools spanning 11 counties. The company says the installation provides secure processing, increased bandwidth, and low-latency compute closer to users.

According to Duos Edge AI, the deployment is designed to reduce reliance on remote data centres and improve access to digital services, including AI-based applications and cloud platforms, particularly for schools in rural and underserved areas.

The Abilene installation follows earlier deployments in Amarillo, Waco, and Victoria, and is aligned with the company’s strategy to develop distributed edge capacity for education, healthcare, and enterprise use cases.

Doug Recker, President of Duos and founder of Duos Edge AI, comments, “We are excited to partner with Region 14 ESC to bring cutting-edge technology to Abilene and West Texas, bringing a carrier neutral colocation facility to the market while empowering educators and communities with the tools they need to thrive in a digital world.”

Region 14 ESC Executive Director Chris Wigington adds, “Collaborating with Duos Edge AI allows us to elevate the technological capabilities of our schools and partners, ensuring equitable access to high-speed computing and AI resources.”

The facility is scheduled to become operational in early 2026, with a launch event planned.

For more from Duos Edge AI, click here.

Joe Peck - 9 January 2026

Data Centre Build News & Insights

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Data Centre Projects: Infrastructure Builds, Innovations & Updates

Edge Computing in Modern Data Centre Operations

Duos Edge AI expands US edge data centres

Duos Technologies Group, through its subsidiary Duos Edge AI, a provider of edge data centre (EDC) systems, has expanded its EDC footprint in Texas and entered the Illinois market, serving the Greater Chicago area.

The company reports continued deployments across several Texas locations and that the Illinois site represents its first installation in the Midwest.

Duos Edge AI says further sites are planned as part of a broader geographic expansion.

Texas and Midwest deployments

In Texas, Duos Edge AI has added two edge data centres in Lubbock to support carrier neutral requirements. The company has also deployed sites supporting education, healthcare, and service providers in Amarillo, Victoria, Waco, Dumas, and Corpus Christi.

The Illinois deployment is located in the Greater Chicagoland area and is described as the first of multiple planned installations in the Midwest.

According to the company, the Lubbock sites are intended to address service provider demand, while the broader Texas portfolio supports a range of public and private sector use cases.

Duos Edge AI’s modular edge data centres include security controls aligned with SOC 2 Type II certification under AICPA standards. The company also references its patented modular data centre entryway design, which is intended to protect equipment in controlled environments.

Commenting on the expansion, Doug Recker, President of Duos and founder of Duos Edge AI, says, “Expanding within Texas and into the Illinois market is a meaningful milestone that reflects both execution discipline and rising demand for our Edge Data Center.

"We are building a scalable, repeatable deployment model that supports education, carriers, and enterprises with secure, low-latency infrastructure.

"These expansions align with our growth strategy and reinforce our confidence in continued momentum as we execute against our long-term guidance.”

Duos Edge AI states that it plans to expand into additional US states, focusing on carrier neutral facilities that support localised compute and edge infrastructure requirements in a range of markets.

For more from Duos Edge AI, click here.

Joe Peck - 2 January 2026

Data Centre Build News & Insights

Data Centre Operations: Optimising Infrastructure for Performance and Reliability

Data Centre Projects: Infrastructure Builds, Innovations & Updates

Modular Data Centres in the UK: Scalable, Smart Infrastructure

Vertiv, GreenScale to deploy DC platforms across Europe

Vertiv, a global provider of critical digital infrastructure, and GreenScale, a developer of hyperscale data centre campuses, have announced a strategic collaboration to deliver factory-integrated data centre platforms engineered for next-generation AI workloads in Europe.

Following a competitive pre-qualification questionnaire (PQQ) process, GreenScale selected Vertiv as its preferred provider for standardised, prefabricated Vertiv OneCore hybrid-built data centres.

While GreenScale will manage slab-down construction and site-wide infrastructure, Vertiv will provide AI-ready data centre modules engineered to support liquid-cooled deployments of NVIDIA Grace Blackwell GB200/300 graphic processing units (GPUs), including next-generation Vera Rubin GPUs.

Vedran Brzic, VP Infrastructure Solutions Business EMEA at Vertiv, says, “AI workloads demand density and speed. By integrating the Vertiv OneCore platform into GreenScale’s standard design, we can help to accelerate deployment of scalable infrastructure for AI, high-performance (HPC), and high-density computing.

"Our scalable prefabricated solution integrates our proven power, thermal, and IT infrastructure into a single factory-assembled system that can help customers deploy high-density capacity more efficiently while increasing reliability and performance.”

Vertiv's OneCore platform

The Vertiv OneCore platform supports up to 200+ kW per rack and features coolant distribution units (CDUs) with a dual-loop liquid cooling system.

The platform is supported by Vertiv SmartRun overhead prefabricated infrastructure, which includes an integrated secondary fluid network (SFN) for liquid-cooled thermal management - optimised for GPU-intensive architectures - and power distribution.

Modules arrive factory-built and pre-tested, with GreenScale providing comprehensive site services including grid integration, permitting, battery monitoring system (BMS)/security systems, and slab-down construction.

Dan Thomas, CEO at GreenScale, comments, “Our collaboration with Vertiv aligns perfectly with GreenScale’s mission to rapidly deploy high efficiency, AI-ready infrastructure across Europe. By standardising on Vertiv’s prefabricated platforms, we gain significant advantages in speed-to-market, quality control, and operational efficiency.

"Their proven experience in high-density cooling solutions and factory-integrated approach helps us minimise on-site complexity while enabling our facilities to be optimised for the most demanding AI workloads. This standardised platform approach will be instrumental in executing our ambitious expansion plans across Northern Ireland and the Nordics.”

GreenScale plans to expand with approximately 120 MW in Northern Ireland and over 300 MW across the Nordics, with a long-term vision to deploy close to 1 GW across Europe.

The company says it aims to implement a high-performance compute model that aligns its objectives and timelines with "technology providers who can efficiently deliver scalable, AI-ready solutions."

For more from Vertiv, click here.

Joe Peck - 17 December 2025

Head office & Accounts:

Suite 14, 6-8 Revenge Road, Lordswood

Kent ME5 8UD

T: +44 (0)1634 673163

F: +44 (0)1634 673173